Public Disclosure

Date as at 31 March 2024

For the period 1 April 2023 to 31 March 2024

Overview and summary

Frere Hall Capital Management Ltd is regulated by the Financial Conduct Authority (“FCA”) as a Markets in Financial Instruments (“MiFID”) firm and subject to the rules and requirements of the FCA’s Prudential Sourcebook for MiFID Investments Firms (“MIFIDPRU”) handbook.

For the purposes of MIFIDPRU, the Firm has been classified as a small non-interconnected (“SNI”) firm.

The Firm has produced this Public Disclosure Document in line with the rules and requirements of MIFIDPRU 8, as applicable to SNI firms.

This Public Disclosure Document has been prepared based on the audited financials as at 31 March 2024, covering the financial period 1 April 2023 to 31 March 2024

The Firm’s main business activity is the provision of investment management services.

Risk management objectives and policies

The Firm has implemented and embedded risk management framework, policies and procedures across all relevant risk areas of the Firm. The Board of Directors sets the business strategy and risk appetite statement of the Firm, which flows through to the risk management framework of the Firm.

In line with the Firm’s business strategy, risk appetite and risk management framework the Firm identifies and further assesses key risks within the Firm’s Internal Capital and Risk Assessment (“ICARA”) process.

The Firm maintains a risk register, which includes risk assessment and rating methodologies in accordance with its risk appetite statement. Key risks are reported to the Board of Directors at each meeting.

Own funds requirements – MIFIDPRU 4

As an SNI firm without permissions for dealing as principle or holding client money or client assets, the Firm is subject to a Permanent Minimum Requirement of £75,000 .

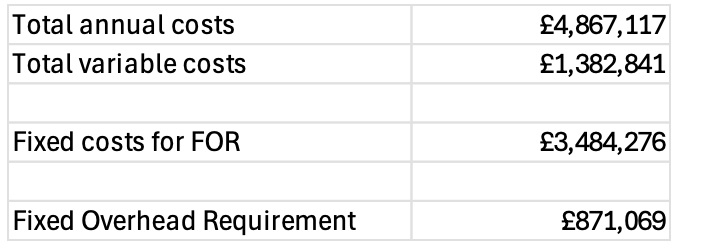

The Firm calculates its own funds requirements based on the Fixed Overhead Requirement (“FOR”) calculation and is not subject to any K-factor requirements.

The Firm has further assessed any risks facing its business operations within its ICARA and quantified additional own funds and liquidity, where required.

Concentration risk – MIFIDPRU 5

The Firm does not conduct any trading on own account and does not have regulatory permissions for dealing as principal. The Firm therefore does not have any concentration risks on or off balance sheet and does not operate a trading book.

Liquidity – MIFIDPRU 6

The Firm maintains minimum liquidity at all times in compliance with the Basic Liquid Asset Requirement (BLAR), being at least 1/3 of its FOR.

The Firm does not provide any client guarantees and therefore its entire liquidity requirement is driven by its expenses, as captured by the FOR.

As part of the ICARA, the Firm also maintains liquidity to satisfy its net wind-down costs and any additional liquidity requirements which the ICARA identified for supporting the ongoing business activities of the Firm.

Own funds

The Firm calculates tis own funds requirements as an SNI firm in line with the rules and requirements in MIFIDPRU 4.3 for SNI firms.

In addition, the Firm has completed its ICARA and analysis to determine its net wind-down requirements and any additional own fund requirements to fund its on-going operations.

The Firm’s risk appetite statement and assessment of risks through its risk management framework and risk register form the basis of its ICARA and assessment of the overall financial adequacy rule in line with MIFIDPRU 7.4.7.

The Board of Directors reviews, challenges and approves the ICARA and conclusions of own funds requirements.

Remuneration arrangements

The Firm has adopted a remuneration policy and procedures that comply with the requirements of chapter 19G of the FCA's Senior Management Arrangements, Systems and Controls Sourcebook (“SYSC”).

In accordance with MIFIDPRU 8.6.2 the Firm makes the following qualitative remuneration disclosures:

- The Firm’s remuneration policies and practices are reviewed annually to ensure they are appropriate and proportionate to the nature, scale, and complexity of the risks inherent in the business model and the activities of the firm.

- The Board of Directors, as the de facto Remuneration Committee, is directly responsible for the overall remuneration policy.

- The Firm ensures that its remuneration structure promotes effective risk management and balances the fixed and variable remuneration components for all staff.

- Variable remuneration is adjusted in line with capital and liquidity requirements as well as the Firm’s performance.

All employees are eligible to receive variable remuneration.

The Firm’s Remuneration Policy sets out the criteria for setting fixed and variable remuneration. All remuneration paid to staff members is clearly categorised as either fixed or variable remuneration. Fixed remuneration is based upon staff members’ professional experience and organisational responsibility. It is permanent, pre-determined, non-discretionary, non-revocable and not dependent on performance. Variable remuneration is based upon staff members’ performance or, in exceptional cases, other variables.

Total remuneration is based on balancing both financial and non-financial indicators together with the performance of the Firm. The Firm ensures that fixed and variable components of the total remuneration are appropriately balanced; and the fixed component represents a sufficiently high proportion of the total remuneration to enable the operation of a fully flexible policy on variable remuneration. The Firm monitors fixed to variable compensation to ensure SYSC 19G is adhered to with respect to Total Remuneration.

Quantitative Remuneration

All firms are required to publicly disclose certain quantitative information in relation to the levels of remuneration awarded. As an SNI firm and in accordance with MIFIDPRU 8.6.8, Frere Hall is required to disclose the total amount of remuneration awarded to all staff, split into fixed and variable remuneration.

For the performance year ending 31 March 2024:

Total fixed remuneration awarded: £914,815

Total variable remuneration awarded: £1,400,000

Total remuneration awarded: £2,314,815